D

Docker

Guest

December 19, 2012: On December 18, ABF management and the International union exchanged bargaining proposals in Kansas City.

ABF Teamsters have reason to be concerned.

The corporation has made it clear that they want concessions and with DVDs and captive audience meetings, they are spending time and money trying to soften up ABF Teamsters.

The Hoffa administration is saying No, which is a good start. But the Hoffa administration has previously shown how easily they fall for concessions. Their record of pension cuts, dividing the Central States Pension Plan, and other give aways has members worried. Two years ago it took a rejection vote by ABF Teamsters to stop a 10% pay cut.

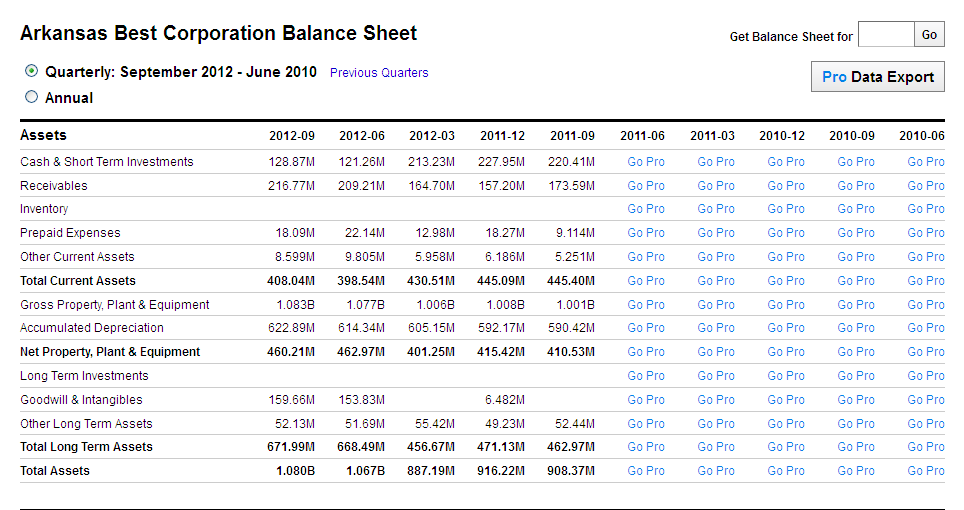

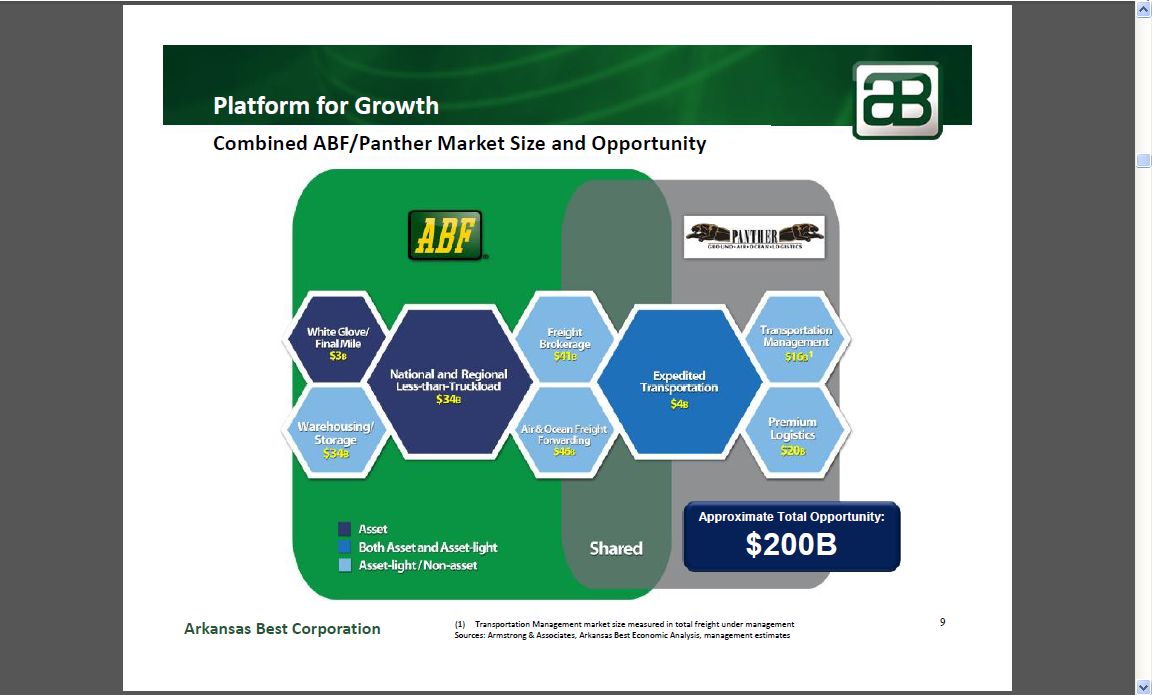

It’s true that ABF is operating in hard times: the economic recovery in trucking is still slow, but Teamsters have seen that ABF has the money to pay bonuses and salary hikes to top execs, and to buy Panther in 2012.

“No Givebacks!†ABF Bargaining opens | Teamsters for a Democratic Union

ABF Teamsters have reason to be concerned.

The corporation has made it clear that they want concessions and with DVDs and captive audience meetings, they are spending time and money trying to soften up ABF Teamsters.

The Hoffa administration is saying No, which is a good start. But the Hoffa administration has previously shown how easily they fall for concessions. Their record of pension cuts, dividing the Central States Pension Plan, and other give aways has members worried. Two years ago it took a rejection vote by ABF Teamsters to stop a 10% pay cut.

It’s true that ABF is operating in hard times: the economic recovery in trucking is still slow, but Teamsters have seen that ABF has the money to pay bonuses and salary hikes to top execs, and to buy Panther in 2012.

“No Givebacks!†ABF Bargaining opens | Teamsters for a Democratic Union