You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ABF | ArcBest First Quarter 2018 Results

- Thread starter Docker

- Start date

-

- Tags

- abf freight

Freightmaster1

TB Legend

- Credits

- 602

Nice that they waited until the contract vote was over!

Nice that they waited until the contract vote was over!

Judy said that she wouldn't have it any other way... lol

Did anybody doubt they would turn a good profit? And look it will be higher when they do a GAAP accounting this was a joke.Nice that they waited until the contract vote was over!

Just proving you don’t work here.When will the 1st quarter bonus checks be mailed?

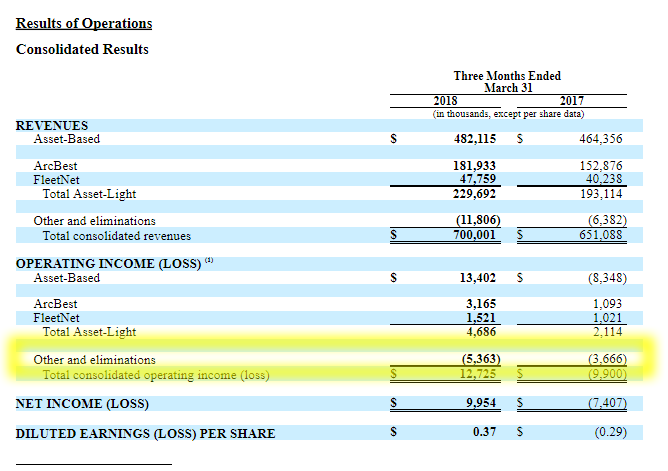

The loss reported in the “Other and eliminations” line of consolidated operating income (loss) which totaled $5.4 million and $3.7 million for the three months ended March 31, 2018 and 2017, respectively, includes $0.4 million and $0.7 million, respectively, of the previously mentioned restructuring charges related to our enhanced market approach. The “Other and eliminations” line also includes expenses related to investments for improving the delivery of services to ArcBest’s customers, investments in comprehensive transportation and logistics services across multiple operating segments, and other investments in ArcBest technology and innovations. As a result of these ongoing investments and other corporate costs, we expect the loss reported in “Other and eliminations” for second quarter 2018 to be consistent with first quarter 2018 and to be approximately $20.0 million for full year 2018.

In addition to the above items, consolidated net income (loss) and earnings (loss) per share were impacted by nonunion defined benefit pension expense, including settlement, and income from changes in the cash surrender value of variable life insurance policies, both of which are reported below the operating income (loss) line in the consolidated statements of operations. A portion of our variable life insurance policies have investments, through separate accounts, in equity and fixed income securities and, therefore, are subject to market volatility. Changes in the cash surrender value of life insurance policies did not impact our diluted earnings per share for the three months ended March 31, 2018, but contributed $0.02 per diluted share for the three months ended March 31, 2017.

The loss reported in the “Other and eliminations” line of consolidated operating income (loss) which totaled $5.4 million and $3.7 million for the three months ended March 31, 2018 and 2017, respectively, includes $0.4 million and $0.7 million, respectively, of the previously mentioned restructuring charges related to our enhanced market approach. The “Other and eliminations” line also includes expenses related to investments for improving the delivery of services to ArcBest’s customers, investments in comprehensive transportation and logistics services across multiple operating segments, and other investments in ArcBest technology and innovations. As a result of these ongoing investments and other corporate costs, we expect the loss reported in “Other and eliminations” for second quarter 2018 to be consistent with first quarter 2018 and to be approximately $20.0 million for full year 2018.

In addition to the above items, consolidated net income (loss) and earnings (loss) per share were impacted by nonunion defined benefit pension expense, including settlement, and income from changes in the cash surrender value of variable life insurance policies, both of which are reported below the operating income (loss) line in the consolidated statements of operations. A portion of our variable life insurance policies have investments, through separate accounts, in equity and fixed income securities and, therefore, are subject to market volatility. Changes in the cash surrender value of life insurance policies did not impact our diluted earnings per share for the three months ended March 31, 201

When Muler retires we should be able to that down to 95.0

The loss reported in the “Other and eliminations” line of consolidated operating income (loss) which totaled $5.4 million and $3.7 million for the three months ended March 31, 2018 and 2017, respectively, includes $0.4 million and $0.7 million, respectively, of the previously mentioned restructuring charges related to our enhanced market approach. The “Other and eliminations” line also includes expenses related to investments for improving the delivery of services to ArcBest’s customers, investments in comprehensive transportation and logistics services across multiple operating segments, and other investments in ArcBest technology and innovations. As a result of these ongoing investments and other corporate costs, we expect the loss reported in “Other and eliminations” for second quarter 2018 to be consistent with first quarter 2018 and to be approximately $20.0 million for full year 2018.

In addition to the above items, consolidated net income (loss) and earnings (loss) per share were impacted by nonunion defined benefit pension expense, including settlement, and income from changes in the cash surrender value of variable life insurance policies, both of which are reported below the operating income (loss) line in the consolidated statements of operations. A portion of our variable life insurance policies have investments, through separate accounts, in equity and fixed income securities and, therefore, are subject to market volatility. Changes in the cash surrender value of life insurance policies did not impact our diluted earnings per share for the three months ended March 31, 2018, but contributed $0.02 per diluted share for the three months ended March 31, 2017.

Just shows what kind of deceitful people we work for....Nice that they waited until the contract vote was over!

Did anybody doubt they would turn a good profit?

And the profits will be continuing to increase...

Asset-Based Revenues — April 2018

Asset-Based billed revenues for the month of April 2018 increased approximately 7% above April 2017 on a per-day basis, reflecting an increase in total billed revenue per hundredweight of approximately 11%, partially offset by a decrease in average daily total tonnage of approximately 4%. The higher revenue per hundredweight measure benefited from the effect of yield improvement initiatives and higher fuel surcharges. The decrease in tonnage levels for April 2018, compared to the same prior-year period, reflects reductions in LTL tonnage related to our ongoing yield management initiatives and changes in account mix, partially offset by year-over-year growth in our Asset-Based truckload-rated business. Total shipments per day decreased approximately 9% in April 2018, compared to April 2017. Influenced by improved yield and lower shipment counts, total revenue per shipment increased approximately 17% in April 2018, versus the same prior-year period. Total weight per shipment increased approximately 5% in April 2018, compared to April 2017, as a result of the Asset-Based segment handling more spot volume truckload-rated shipments during April 2018.

canaryinthemine

Retirement....The Job I Was Born To Have!

- Credits

- 0

When will the 1st quarter bonus checks be mailed?

Nope Rollin,........they have to go an entire year with an O.R. lower than 96..........

For 5 years running,....we just....”missed” ......our bonuses by just a few tenths of a percent......

Something about Fort Smith needing new drapes for the corporate lunchroom one year.......Ms. McReynold’s car needed snow tires the next year........

Oh so close.........but...No Bonus For You!