You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Yellow | In tax terms ( taking a loss )

- Thread starter jacks

- Start date

I got a copy of the tax return that is being circulated around and was prepared by Stallard & Associates of a persons 2106 form and it what they are talking about is Line 3 of Itemized deductions, not income and since the questions still haven't been answered as to the authenticity of the letter saying that this is fake and not to do it, I stopped by my accountants office today.

She informed me that it is not bogus and that if certain criteria are met such as filing a long form, 2106, etc it is possible to deduct a percentage of wages lost for "preseveration of income" in the itemized deductions(not income).

I am not a tax accountant or did I stay at a holiday inn last night and in the example tax return it looks like less than 2% of adjusted gross income, but that may help. She also went on to say that she will provide me with all the info when she does my taxes later this year and that this would have not helped me in the past due to my business and that your not going to get back the thousands and thousands and thousands of dollars taken from your pay. In short the law is there for people who have entered into an agreement and after have had to forfeit wages.

She informed me that it is not bogus and that if certain criteria are met such as filing a long form, 2106, etc it is possible to deduct a percentage of wages lost for "preseveration of income" in the itemized deductions(not income).

I am not a tax accountant or did I stay at a holiday inn last night and in the example tax return it looks like less than 2% of adjusted gross income, but that may help. She also went on to say that she will provide me with all the info when she does my taxes later this year and that this would have not helped me in the past due to my business and that your not going to get back the thousands and thousands and thousands of dollars taken from your pay. In short the law is there for people who have entered into an agreement and after have had to forfeit wages.

I got a copy of the tax return that is being circulated around and was prepared by Stallard & Associates of a persons 2106 form and it what they are talking about is Line 3 of Itemized deductions, not income and since the questions still haven't been answered as to the authenticity of the letter saying that this is fake and not to do it, I stopped by my accountants office today.

She informed me that it is not bogus and that if certain criteria are met such as filing a long form, 2106, etc it is possible to deduct a percentage of wages lost for "preseveration of income" in the itemized deductions(not income).

I am not a tax accountant or did I stay at a holiday inn last night and in the example tax return it looks like less than 2% of adjusted gross income, but that may help. She also went on to say that she will provide me with all the info when she does my taxes later this year and that this would have not helped me in the past due to my business and that your not going to get back the thousands and thousands and thousands of dollars taken from your pay. In short the law is there for people who have entered into an agreement and after have had to forfeit wages.

Where did she get her degree, Frank's Accounting School in the back lot of Love's Truck Stop?

You can contact her at her office located within the Menard federal penitentiary, Marion,Il.Where did she get her degree, Frank's Accounting School in the back lot of Love's Truck Stop?

Where did she get her degree, Frank's Accounting School in the back lot of Love's Truck Stop?

No, Is that the tax service you use?

Oh, I get it, humor. I don't know where she got her degree, there's 4 accountants and 8 other employees and they sign there name to my returns. For all I know she could have had a 4 day course at *&R block. She does have some official looking documents on the wall, but those could be printed up like all the stuff the sheep read on the internet.

I have been audited in the past and came out clean, so what's the worse that could happen someone else put there hand in my pocket to the tune of 20 grand a year, the point is many Union employees not only Teamsters have taken it hard and if it's legal and you deserve credit shouldn't you be informed?

Where did she get her degree, Frank's Accounting School in the back lot of Love's Truck Stop?

Didn't one of you guys say that you were going to let us know what your former IRS tax agent said?

No, Is that the tax service you use?

Oh, I get it, humor. I don't know where she got her degree, there's 4 accountants and 8 other employees and they sign there name to my returns. For all I know she could have had a 4 day course at *&R block. She does have some official looking documents on the wall, but those could be printed up like all the stuff the sheep read on the internet.

I have been audited in the past and came out clean, so what's the worse that could happen someone else put there hand in my pocket to the tune of 20 grand a year, the point is many Union employees not only Teamsters have taken it hard and if it's legal and you deserve credit shouldn't you be informed?

Where did she get her degree, Frank's Accounting School in the back lot of Love's Truck Stop?

Didn't one of you guys say that you were going to let us know what your former IRS tax agent said?

Where did she get her degree, Frank's Accounting School in the back lot of Love's Truck Stop?

No, Is that the tax service you use?

Oh, I get it, humor. I don't know where she got her degree, there's 4 accountants and 8 other employees and they sign there name to my returns. For all I know she could have had a 4 day course at *&R block. She does have some official looking documents on the wall, but those could be printed up like all the stuff the sheep read on the internet.

I have been audited in the past and came out clean, so what's the worse that could happen someone else put there hand in my pocket to the tune of 20 grand a year, the point is many Union employees not only Teamsters have taken it hard and if it's legal and you deserve credit shouldn't you be informed?

Where did she get her degree, Frank's Accounting School in the back lot of Love's Truck Stop?

Didn't one of you guys say that you were going to let us know what your former IRS tax agent said?

Twisty, sorry for the bit of sarcastic humor, but this topic has just about been beaten to death on here. I have no idea where your accountant is coming from on all of this but here it is in a nutshell. There is no way any of us can claim a refund on wages we never got and on which we never paid any tax. The W-2's we all received at the end of the year show our actual gross pay for the year, not some imaginary amount we were "supposed" to get. We are taxed on that real amount and there is no extra tax paid on any other amount, and therefore nothing to claim as a refund for tax paid on wages we were "supposed to get".

Twisty, sorry for the bit of sarcastic humor, but this topic has just about been beaten to death on here. I have no idea where your accountant is coming from on all of this but here it is in a nutshell. There is no way any of us can claim a refund on wages we never got and on which we never paid any tax. The W-2's we all received at the end of the year show our actual gross pay for the year, not some imaginary amount we were "supposed" to get. We are taxed on that real amount and there is no extra tax paid on any other amount, and therefore nothing to claim as a refund for tax paid on wages we were "supposed to get".

Twisty, the 2106 - Employee Business Expense form is for expenses actually paid out. No one "paid" anything to YRC. We agreed to work for 15% less that's all. If someone is foolish enough to claim the 15% as an "expense" then that person will get nailed by the IRS when his numbers don't match up. If you are claiming that 15% as an expense then you have to show on your gross income that you actually received it in the first place (which you did not).

Twisty, I get what you are saying. I am choosing not to take this because the KGB...er IRS is an organization that even the Teamsters don't want to mess with.I got a copy of the tax return that is being circulated around and was prepared by Stallard & Associates of a persons 2106 form and it what they are talking about is Line 3 of Itemized deductions, not income and since the questions still haven't been answered as to the authenticity of the letter saying that this is fake and not to do it, I stopped by my accountants office today.

She informed me that it is not bogus and that if certain criteria are met such as filing a long form, 2106, etc it is possible to deduct a percentage of wages lost for "preseveration of income" in the itemized deductions(not income).

I am not a tax accountant or did I stay at a holiday inn last night and in the example tax return it looks like less than 2% of adjusted gross income, but that may help. She also went on to say that she will provide me with all the info when she does my taxes later this year and that this would have not helped me in the past due to my business and that your not going to get back the thousands and thousands and thousands of dollars taken from your pay. In short the law is there for people who have entered into an agreement and after have had to forfeit wages.

captmickey

TB Lurker

- Credits

- 0

Twisty, the 2106 - Employee Business Expense form is for expenses actually paid out. No one "paid" anything to YRC. We agreed to work for 15% less that's all. If someone is foolish enough to claim the 15% as an "expense" then that person will get nailed by the IRS when his numbers don't match up. If you are claiming that 15% as an expense then you have to show on your gross income that you actually received it in the first place (which you did not).

Twisty, Read IRS Pub 529. One can deduct form 2106 expenses, related to gross income. The wage giveback was not reported on W-2. Filing on form 2106 for the giveback as a deduction is not valid. here is the item from Pub 529 that would apply:

You can deduct certain other expenses as miscellaneous

itemized deductions subject to the 2%-of-adjusted-gross-income

limit. On Schedule A (Form 1040),

line 23, or Schedule A (Form 1040NR), line 9, you can deduct

the ordinary and necessary expenses that you pay:

1. To produce or collect income that must be included in

your gross income,

I am not an expert, but I am an IRS Certified volunteer tax counselor.

I hope they remember to send Thank You notes to all the 'Economic Advisors' on here and in the terminals that encouraged filing for such a refund.Here is a interesting development going on at my terminal. Currently several PND drivers are now being audited by the IRS regarding this 15% "deduction". One driver has been told he owes thousands plus penalties. It also looks like the IRS is going after YRC employees as this appears to be "low hanging fruit" this also may be why they are no longer showing the 15% on our check stubs

In Twisty's scenario it came to a part of less than 2% of earned income. Basically, at most, 1200-2000. In my opinion, even tho I could use the money, that's nowhere near worth risking an audit, repayment plus interest, penalties, or jail...Twisty, I get what you are saying. I am choosing not to take this because the KGB...er IRS is an organization that even the Teamsters don't want to mess with.

Freightmaster1

TB Legend

- Credits

- 605

In Twisty's scenario it came to a part of less than 2% of earned income. Basically, at most, 1200-2000. In my opinion, even tho I could use the money, that's nowhere near worth risking an audit, repayment plus interest, penalties, or jail...

This is getting more interesting as the days go by. One of our drivers who is being audited has been told the IRS has launched a major investigation as to who was giving the advice that the 15% could be deducted. The agent said someone is going to go to prison over this. The driver only has to pay back $8000 plus penalties

- Credits

- 534

This is getting more interesting as the days go by. One of our drivers who is being audited has been told the IRS has launched a major investigation as to who was giving the advice that the 15% could be deducted. The agent said someone is going to go to prison over this. The driver only has to pay back $8000 plus penalties

Easy...Liberty Tax..... Smyrna, TN

Freightmaster1

TB Legend

- Credits

- 605

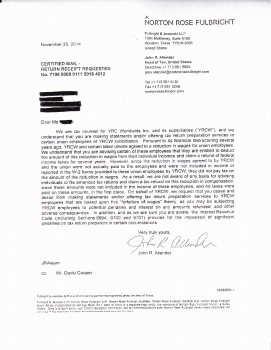

This was from post #109 back on December 6, 2014. What is it that people still don't understand about this issue?

Freightmaster1

TB Legend

- Credits

- 605