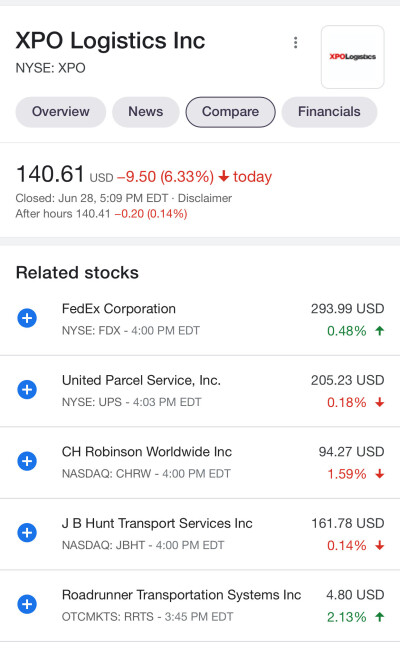

This has to do with Xpo insiders selling their stock now . Generally you sell stock at the point you feel it may have reached its peak . What do the insiders possibly know .... that’s the point . It was not a criticism of them selling their stock.well if you bought it at $50 a share would you sell it...That's what you told us on how to pay for a new car

Last edited: