Don't get mad. It'll be alright.Hey genius, do you know how to use a financial calculator? Do you know how to calculate time value of money? Do you know how to do an annuity calculation based on regular investments, interest rate, time, and then calculate future value of that annuity? Pull your somewhat ignorant head out of your butt and learn something then come back here with some intelligent comments.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ABF | 2023 Contract Proposals

- Thread starter Steward of the Rock

- Start date

I doubt that....the union is meeting with locals in Washington DC this month to talk about what they plan on proposing.... I don't see how your stewards timeline is possible...I’m at an end of line smaller terminal. Our steward here thinks we will have proposals to vote on in the next 30-45 days or so. This is my first contract with ABF. Any truth to that?

NoI’m at an end of line smaller terminal. Our steward here thinks we will have proposals to vote on in the next 30-45 days or so. This is my first contract with ABF. Any truth to that?

- Credits

- 551

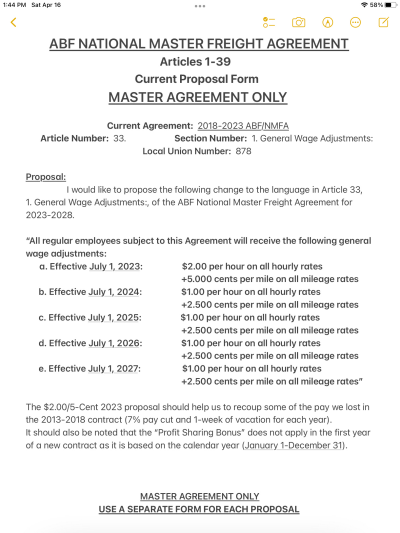

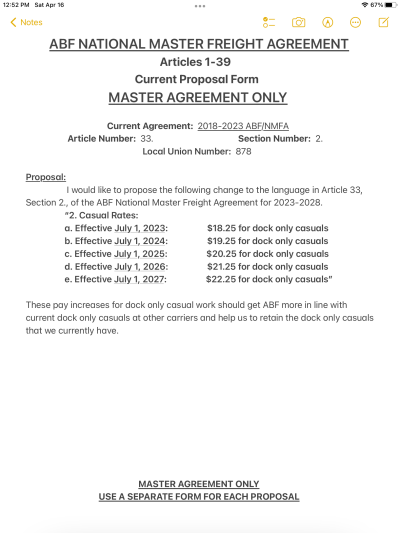

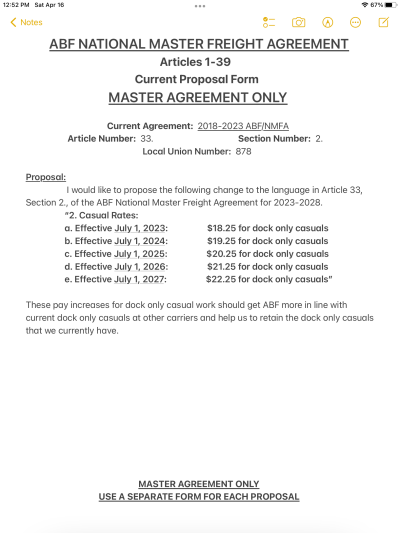

Saw yesterday they started negotiating so I am pretty happy. Hopefully we get to hear something soon. I am way more excited over this than the hubs. LolI know it is still a little early for the 2023 Contract Proposals, but I figured we could use the Trucking Boards platform to post what we have or what we would like have or change. Hopefully, the OZ slate has someone that reads these boards and they will get an idea of what we would like to see changed. I will start off posting two of the thirty-five proposals that I have come up with so far

You don't need to if your employer is putting in a large portion of it.How can you put 432.90 from your pay a week into a 401?

Razorblade

Omniscient

- Credits

- 636

Dollar for dollar employer match means you only put in about $200 or whatever amount you choose. With your income, you should be putting that much away already.You don't need to if your employer is putting in a large portion of it.

I agree.Dollar for dollar employer match means you only put in about $200 or whatever amount you choose. With your income, you should be putting that much away already.

Streaker69

The Influencer

- Credits

- 805

ABF Negotiations Update: April 14, 2023

This week, the Teamsters National Freight Industry Negotiating Committee (TNFINC) met with ABF Freight in Kansas City to continue negotiations for a new ABF Nat

At least they're talking...

Tonkatruck

TB Lurker

- Credits

- 104

I really hope that We all get something much better than that low ball , When UPS Already is making way much money than us in ABF they already talking about getting another raise , Sorry $2 Raise look like an insult to all the ABF drivers ( teamsters ), considering We have that 7% pay cut , while ABF Claim they were having so much economic problems in the year before , they purchased few extra Companies the soonest the Contract got approved . Sorry I don't agree with your $2 dollar bargain, and I pray that whoever is talking for all of us in those meeting they have enough back bones to said things like they are and put us where We really need to be in 2023 and so on .I know it is still a little early for the 2023 Contract Proposals, but I figured we could use the Trucking Boards platform to post what we have or what we would like have or change. Hopefully, the OZ slate has someone that reads these boards and they will get an idea of what we would like to see changed. I will start off posting two of the thirty-five proposals that I have come up with so far

That was one of SORs early posts....he was bouncing around ideas here looking for input...he actually proposed $7 an hour as did I when we submitted proposals....I submitted over 20 proposals to my local, he submitted over 100....how many did you submit to your local?I really hope that We all get something much better than that low ball , When UPS Already is making way much money than us in ABF they already talking about getting another raise , Sorry $2 Raise look like an insult to all the ABF drivers ( teamsters ), considering We have that 7% pay cut , while ABF Claim they were having so much economic problems in the year before , they purchased few extra Companies the soonest the Contract got approved . Sorry I don't agree with your $2 dollar bargain, and I pray that whoever is talking for all of us in those meeting they have enough back bones to said things like they are and put us where We really need to be in 2023 and so on .

Steward of the Rock

TB Veteran

- Credits

- 726

Go to page 13, post #260. Myself and several others submitted this proposal to start off at $7.00 per hour. The post you read ($2.00) was from April of last year. Many things have changed since that time.I really hope that We all get something much better than that low ball , When UPS Already is making way much money than us in ABF they already talking about getting another raise , Sorry $2 Raise look like an insult to all the ABF drivers ( teamsters ), considering We have that 7% pay cut , while ABF Claim they were having so much economic problems in the year before , they purchased few extra Companies the soonest the Contract got approved . Sorry I don't agree with your $2 dollar bargain, and I pray that whoever is talking for all of us in those meeting they have enough back bones to said things like they are and put us where We really need to be in 2023 and so on .