Watch "Tombstone - I have two guns. One for each of you." on YouTubeI have the gun part more than covered

Thanks Smoke. Appreciate you.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FedEx Freight | Pension 401k or portable pension

- Thread starter Crazy Trucker

- Start date

No. Right now about 4%So the portable pension is guaranteed a 8% return? Vs whatever return one gets from the Vanguard fund or whatever is in your 401K?

No F-bdy Bs

TB Veteran

- Credits

- 573

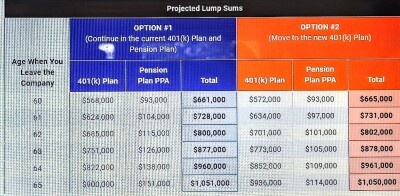

Just for kicks, I ran the #s for myself.

After 15yrs with Fedex, and assuming I was putting in 6% with the new 8% match Vs staying in the pension.

Ultimately, it was a wash, assuming I retired at age 62-65.

Virtually no difference in the end sum. The new pension won out by about $20,000,,,,,,,BUT, that's assuming I saw a 10% overall return until then. Which is possible, but obviously not guranteed. I've maintained a 13.9% return over every 10yrs that I've invested, and more than likely, the market will support that if you do your part.

Still,, only an extra$20k over 20yrs is probably not worth the risk.

I'd have stayed in the old plan.

After 15yrs with Fedex, and assuming I was putting in 6% with the new 8% match Vs staying in the pension.

Ultimately, it was a wash, assuming I retired at age 62-65.

Virtually no difference in the end sum. The new pension won out by about $20,000,,,,,,,BUT, that's assuming I saw a 10% overall return until then. Which is possible, but obviously not guranteed. I've maintained a 13.9% return over every 10yrs that I've invested, and more than likely, the market will support that if you do your part.

Still,, only an extra$20k over 20yrs is probably not worth the risk.

I'd have stayed in the old plan.

Where do you think pension money is invested?Anyone ever consider the non stop printing of money and the possibility of markets collapsing not just once but several times? It just doesn't feel like the old days with market corrections. Kinda feels like we're on the titanic ya know? I'm not an expert but thats not good for anyone and I would think that 401k would be hit harder in those situations. Just saying

same place 401 money is

Great job, load up Roth to max then put in 401k until it hurts, keep your self in lower tax bracket with 401 k contributions. You are on right track stay the course and reap the rewards when you retire.By traditional standards, I have a little over 30 years before retirement and I've been at FedEx for 2 years. I'm hoping to retire in 20 years by investing in ETFs, my Roth IRA and my 401K.

It's on truckingboards now. Somebody will pull this up in 20 years and either compliment me or call me a liar. Time will tell.

No F-bdy Bs

TB Veteran

- Credits

- 573

Not trying to dig into your affairs, but are you barely contributing to the 401?

screweddaily

TB Lurker

- Credits

- 237

I've got possibly 30 working years left, and non of the new hires are eligible for the pension. Long term I see the pension being froze or completely done away with in that amount of time. 401k, coupled with my other investments provide me with a much greater return over that time period. Beyond that I don’t see myself retiring from fedex, I plan on leaving as soon as I get an opportunity from one of the companies on my short list. Fedex has no interest in looking out for anything beyond their profits and I dont see that changing.

Crazy Trucker

Busting Clowns daily!!!!

- Credits

- 250

I've got possibly 30 working years left, and non of the new hires are eligible for the pension. Long term I see the pension being froze or completely done away with in that amount of time. 401k, coupled with my other investments provide me with a much greater return over that time period. Beyond that I don’t see myself retiring from fedex, I plan on leaving as soon as I get an opportunity from one of the companies on my short list. Fedex has no interest in looking out for anything beyond their profits and I dont see that changing.

Same

No F-bdy Bs

TB Veteran

- Credits

- 573

If the pension is froze or done away with, the tenured employees are no worse off. Aside from that, it's not even a factor for those with less than 10yrs of tenure.

I don't mind. No I've always put a decent amount in. Why? Do you think I should be a millionaire? Maybe I should be but I'm not. I will tell you where I work most all of the guys have nothing except the pension. It takes time really start compounding plus 2 kids through college to the tune of $180k.

- Credits

- 406

(1) collage = 85K all our money .

Now we get to pay off the son in laws 50K .

White middle class , no breaks for you and

they don't share the loop holes .

Now we get to pay off the son in laws 50K .

White middle class , no breaks for you and

they don't share the loop holes .

That should be no problem on your TB salary and doing The Smoke and Gerard Shows…..(1) collage = 85K all our money .

Now we get to pay off the son in laws 50K .

White middle class , no breaks for you and

they don't share the loop holes .

- Credits

- 406

Gerard has been on a drinking binge , don't know what to do with the little bastard .

joes bar and grill

TB Legend

- Credits

- 0

Makes no difference, pension is defined, 401 is notWhere do you think pension money is invested?

same place 401 money is

Better off with 401k than defined.Makes no difference, pension is defined, 401 is not

Contribution or benefit?Makes no difference, pension is defined, 401 is not

joes bar and grill

TB Legend

- Credits

- 0

Who said that, your magic 8 ball?Better off with 401k than defined.

Better off with 401k than defined.

Contribution or benefit?

401 k has far more options verses a pension.Who said that, your magic 8 ball?

Tax deduction at contribution time.

Able to vary amount withdrawn as long as RMD is met.

Can wait and draw as needed if market is going strong.

Remaining balance passes to heirs.

The more you work ( ie linehaul) the more that goes in your account.

If for any reason you leave company 401 will keep growing but your pension is frozen when you leave.

Long list of advantages.