You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FedEx Freight | 401K Match question

- Thread starter xeastend

- Start date

Purple Hammer

On Time Delivery

- Credits

- 384

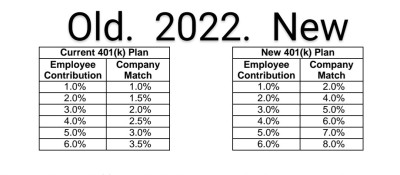

Company match is 8% when the employee puts in 6%. That is the maximum amount no matter how senior you are.

Thank youCompany match is 8% when the employee puts in 6%. That is the maximum amount no matter how senior you are.

Don't forget about the portable Pension that fedex contributes up to 6% For employees hired before 2020. Not for sure how many employees switch to the new 401k that took effect 1 January 2022. Old 401k employee 6% company match 3.5% new 401k employee 6%Visitor. I do not work for FXF. Did a half assed search. No time for a full assed. Thought I read FXF increases the match based on time with the company. Any truth? Thanks.

company match 8%

Streaker69

The Influencer

- Credits

- 809

If I remember correctly, when you start at FedEx they automatically enroll you in the 401k for 3%, and they increase it 1% annually, but you have the option to raise it yourself. I bumped it to 15 as soon as I was able to access the plan.

This has nothing to do with the match though. The match is always there.

This has nothing to do with the match though. The match is always there.

I like that idea. The more you put in, the more the match. My mistake thinking it was based on seniority

We were with TIAA Cref in the days of State Govt Work, the capture is right at 6 percent of our wages (Before taxes) and they put in about that much. Vested in two years back in those days at 100%Company match is 8% when the employee puts in 6%. That is the maximum amount no matter how senior you are.

The problem with TIAA CREF was when it came time to end the employment there after a few years and 100% vested, its all ourn money. That is 10% to Daddy Uncle Sam off the bat. Filed as taxable income to boot for that withdrawal year....

For the next 7 years that they clear all the funds via Annuity only. They do not do cash lump. Only 7 years and then its all your money. Zero.

Each of those years filed as taxable income. kachink cahing etc. We broke even when the dust cleared from the Texas Saloon of 401K in Ye ol Dry Gulch.

What a racket.

Whats unspoken and more dangerous is US Government Pension Funds. Those are raided and emptied down by US Treasury to meet shortfalls at Govt Shutdowns. A few weeks later the Govt Reopens and all that money gets topped off with all those Federal Workers none the wiser.

Theres a shutdown pending 19th Jan and a second one 2nd Feb give or take across 8 of the 12 unfunded or budgeted agencies.