Freightmaster1

TB Legend

- Credits

- 607

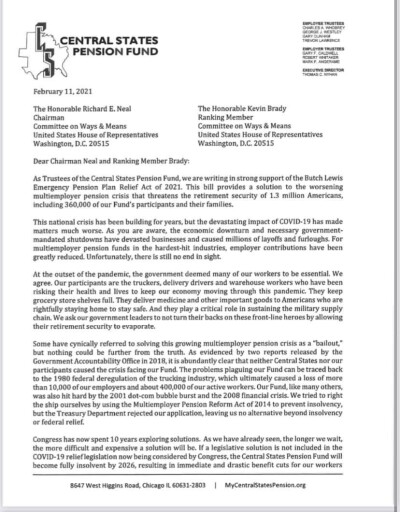

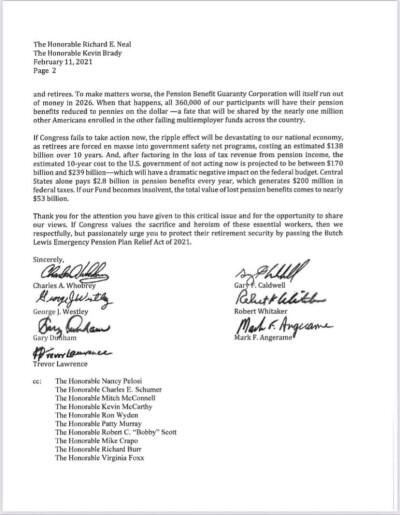

Check this out from our NUCPP Secretary, Dana Vargo. If you missed the live stream of the Markup of the pension legislation, you can watch it here (it starts around the 1:18:54 mark)...

Markup of COVID-19 Relief Legislation--Thursday, February 11, 2021, Pt. 2

FOR MORE INFO ON THE BUDGET RECOMMENDATIONS ON Subtitle H -The Butch Lewis Emergency Pension Plan Relief Act of 2021Section-by-Section SEE THE LINK BELOW...

https://waysandmeans.house.gov/site...use.gov/files/documents/8. Retirement SxS.pdf

Thanks to everyone for your continued support and for staying united in our fight to protect our pensions and our retirement security!

PENSION WARRIORS!!!!!!

WE DID IT! IN CASE YOU DIDN’T HEAR, THE MARKUP OF THE COVID-19 RELIEF LEGISLATION PASSED TODAY WITH A VOTE OF 25-18. THIS MOVES THE BILL ON TO THE FLOOR OF THE HOUSE OF REPRESENTATIVES.

The NUCPP Board of Directors and Advisory Board wish to thank everyone for such an all out effort! WE COULDN’T HAVE DONE THIS WITHOUT THE HELP OF EACH AND EVERYONE OF YOU!!!

Celebrate tonight and we’ll be in touch soon! Good job Pension Warriors!!!!!!!!!

NUCPP Board of Directors

Mike Walden, President

Markup of COVID-19 Relief Legislation--Thursday, February 11, 2021, Pt. 2

|

FOR MORE INFO ON THE BUDGET RECOMMENDATIONS ON Subtitle H -The Butch Lewis Emergency Pension Plan Relief Act of 2021Section-by-Section SEE THE LINK BELOW...

https://waysandmeans.house.gov/site...use.gov/files/documents/8. Retirement SxS.pdf

Thanks to everyone for your continued support and for staying united in our fight to protect our pensions and our retirement security!

PENSION WARRIORS!!!!!!

WE DID IT! IN CASE YOU DIDN’T HEAR, THE MARKUP OF THE COVID-19 RELIEF LEGISLATION PASSED TODAY WITH A VOTE OF 25-18. THIS MOVES THE BILL ON TO THE FLOOR OF THE HOUSE OF REPRESENTATIVES.

The NUCPP Board of Directors and Advisory Board wish to thank everyone for such an all out effort! WE COULDN’T HAVE DONE THIS WITHOUT THE HELP OF EACH AND EVERYONE OF YOU!!!

Celebrate tonight and we’ll be in touch soon! Good job Pension Warriors!!!!!!!!!

NUCPP Board of Directors

Mike Walden, President