You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SAIA | Saia’s Record Or Driven By Higher Yield On Small Revenue Increase

- Thread starter Freightmaster1

- Start date

88.5 & yet they are still "considering" pay increases & didn't they just raise the cost for benefits?

The funny thing about quarterly reporting is that money/numbers are easily manipulated... For example the postdated, lump sum, return of the 401K match was done on the first day of the 4th quarter

The funny thing about quarterly reporting is that money/numbers are easily manipulated... For example the postdated, lump sum, return of the 401K match was done on the first day of the 4th quarter

Curlyheadedfck

TB Lurker

- Credits

- 19

Any faith in the so called wage increase in early 2021?

It was mentioned in the latest video that was released - just not specific amountsAny faith in the so called wage increase in early 2021?

runawaytrain

Wear their scorn with pride.

- Credits

- 10

Saia Q4 easily outpaces forecasts

Less-than-truckload carrier Saia reported fourth-quarter results well ahead of expectations Monday. The company reported record operating results in a “most unique year.”

www.freightwaves.com

www.freightwaves.com

- Credits

- 143

What most don't understand is the operating ratio. 88.5 OR is not 11.5% profit. It is operating income. It is income before taxes and updating or adding additional facilities and equipment.88.5 & yet they are still "considering" pay increases & didn't they just raise the cost for benefits?

The funny thing about quarterly reporting is that money/numbers are easily manipulated... For example the postdated, lump sum, return of the 401K match was done on the first day of the 4th quarter

My last full year before retirement, 2003, Yellow Transportation had an after tax profit of $26 million. My union brothers and sisters thought that was an amazing amount of money. It was $1000 per employee. Each employee created $20 per week in profit.

So where is the one new terminal for the 1st qtr. ? I know there has been one planned for Ct. but not sure if that’s it. Quarter is almost half over.

Saia Q4 easily outpaces forecasts

Less-than-truckload carrier Saia reported fourth-quarter results well ahead of expectations Monday. The company reported record operating results in a “most unique year.”www.freightwaves.com

Never mind , got the rest of the article to open. Wilmington De in the North EastSo where is the one new terminal for the 1st qtr. ? I know there has been one planned for Ct. but not sure if that’s it. Quarter is almost half over.

1523672701

TB Lurker

- Credits

- 0

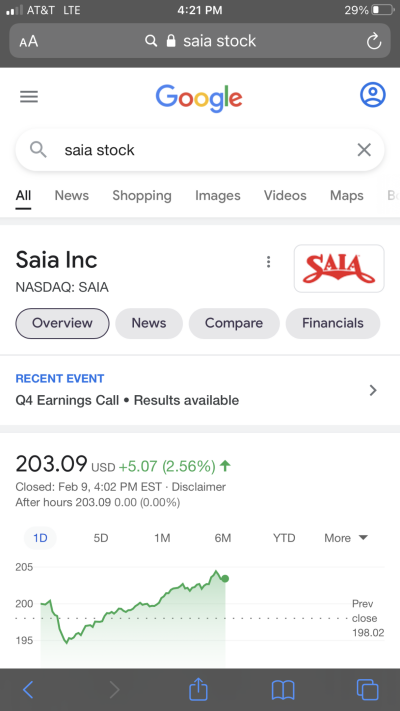

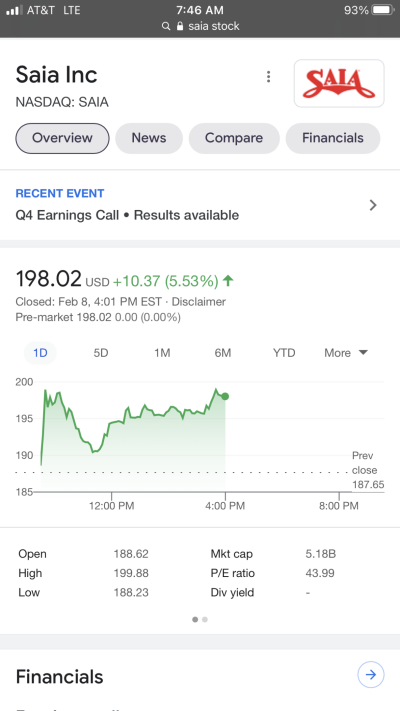

Does anyone wonder why the stock price has climbed from around 70.00 per share mid April 2020 to where it is trading today? Is the truckline doing anything different now than it did then? The answer is no. Wage increases and bonuses were deferred until 2021. Saia is the only LTL truckline to defer or withhold such, during what was a very difficult, unprecedented year. The gamble has resulted in record setting financial results for 2020. Ill be interested to see how that gamble pays off in 2021, and, 2022.

runawaytrain

Wear their scorn with pride.

- Credits

- 10

The former CEO’s brilliant leadership skills. Rick O’dell grew this company internally and didn’t create massive debt with stupid acquisitions like his father-in-law Zollars. He must have taken Zollars advice at the Thanksgiving table. That’s just one of the major reasons. Being union free is another major reason why they have remained the fastest growing LTL company in business today. It’s amazing how restrictive work rules destroy the flexibility and growth of companies. Just look at YRC (now Yellow) and what the Teamsters did to their profit margins. SAIA is the next Old Dominion and will catch them within this decade.Does anyone wonder why the stock price has climbed from around 70.00 per share mid April 2020 to where it is trading today? Is the truckline doing anything different now than it did then? The answer is no. Wage increases and bonuses were deferred until 2021. Saia is the only LTL truckline to defer or withhold such, during what was a very difficult, unprecedented year. The gamble has resulted in record setting financial results for 2020. Ill be interested to see how that gamble pays off in 2021, and, 2022.

runawaytrain

Wear their scorn with pride.

- Credits

- 10

Does anyone wonder why the stock price has climbed from around 70.00 per share mid April 2020 to where it is trading today? Is the truckline doing anything different now than it did then? The answer is no. Wage increases and bonuses were deferred until 2021. Saia is the only LTL truckline to defer or withhold such, during what was a very difficult, unprecedented year. The gamble has resulted in record setting financial results for 2020. Ill be interested to see how that gamble pays off in 2021, and, 2022.

runawaytrain

Wear their scorn with pride.

- Credits

- 10

This is what happens when you keep Hoffa Jr. out of your pockets. He’s a worthless POS! Senior is rolling over in his grave at what his son has done to the Teamsters.

Turn the Page

Let's turn the page back to better times

- Credits

- 0

The former CEO’s brilliant leadership skills. Rick O’dell grew this company internally and didn’t create massive debt with stupid acquisitions like his father-in-law Zollars. He must have taken Zollars advice at the Thanksgiving table. That’s just one of the major reasons. Being union free is another major reason why they have remained the fastest growing LTL company in business today. It’s amazing how restrictive work rules destroy the flexibility and growth of companies. Just look at YRC (now Yellow) and what the Teamsters did to their profit margins. SAIA is the next Old Dominion and will catch them within this decade.

How does the company growing fast and stock price going up help the driver when it comes at the cost of wage increases and bonuses. Higher stock price only fattens wall street investors and upper management at SaiaThis is what happens when you keep Hoffa Jr. out of your pockets. He’s a worthless POS! Senior is rolling over in his grave at what his son has done to the Teamsters.

runawaytrain

Wear their scorn with pride.

- Credits

- 10

When stock is high the company thrives and the result are higher wages and better benefits to labor. It also increases job security and junior men move up in seniority. Just look at Yellows stock and the massive losses. And that’s even with that $700 million loan. SAIA is one of the highest paying LTL companies in the industry. That doesn’t happen by accident!How does the company growing fast and stock price going up help the driver when it comes at the cost of wage increases and bonuses. Higher stock price only fattens wall street investors and upper management at Saia

I've been out of the game for a while now and someone correct me, if I am wrong, but Saia has had an annual wage increase, for the last several years running. As for as SAIA stock goes, you don't think ordinary people , which includes SAIA rank and file employees, are smart enough to own SAIA stock?How does the company growing fast and stock price going up help the driver when it comes at the cost of wage increases and bonuses. Higher stock price only fattens wall street investors and upper management at Saia

runawaytrain

Wear their scorn with pride.

- Credits

- 10

When you look at what we paid for it and you look at what it is today you can only kick yourself in the ass for not buying more.I've been out of the game for a while now and someone correct me, if I am wrong, but Saia has had an annual wage increase, for the last several years running. As for as SAIA stock goes, you don't think ordinary people , which includes SAIA rank and file employees, are smart enough to own SAIA stock?

Turn the Page

Let's turn the page back to better times

- Credits

- 0

I shutter to think someone would to invest a lot of money into stock of their company....EnronI've been out of the game for a while now and someone correct me, if I am wrong, but Saia has had an annual wage increase, for the last several years running. As for as SAIA stock goes, you don't think ordinary people , which includes SAIA rank and file employees, are smart enough to own SAIA stock?

Wouldn't it have been better for the drivers to get a raise and bonus last year instead of having a higher stock price?I've been out of the game for a while now and someone correct me, if I am wrong, but Saia has had an annual wage increase, for the last several years running. As for as SAIA stock goes, you don't think ordinary people , which includes SAIA rank and file employees, are smart enough to own SAIA stock?

runawaytrain

Wear their scorn with pride.

- Credits

- 10

runawaytrain

Wear their scorn with pride.

- Credits

- 10

Like poker, you just need to learn when to walk away.I shutter to think someone would to invest a lot of money into stock of their company....Enron

1523672701

TB Lurker

- Credits

- 0

There is no doubt that Mr. O'Dell grew the company the right way. Through out the years and decades, we have all seen examples of failed acquisitions, mergers, etc.. The point of my post is when a company defers wage increases, bonuses, and 401k contributions, while reporting record financial results, during an un -pressedented pandemic, its worth noticing. Its too early to compare OD and Saia.The former CEO’s brilliant leadership skills. Rick O’dell grew this company internally and didn’t create massive debt with stupid acquisitions like his father-in-law Zollars. He must have taken Zollars advice at the Thanksgiving table. That’s just one of the major reasons. Being union free is another major reason why they have remained the fastest growing LTL company in business today. It’s amazing how restrictive work rules destroy the flexibility and growth of companies. Just look at YRC (now Yellow) and what the Teamsters did to their profit margins. SAIA is the next Old Dominion and will catch them within this decade.