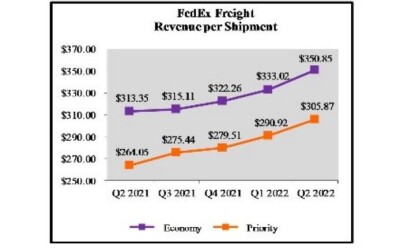

"FedEx Freight revenue increased 17% in the second quarter and 20% in the first half of 2022 primarily due to higher revenue per shipment and increased average daily shipments."

FedEx Freight Segment Operating Income

"FedEx Freight segment operating income increased 33% in the second quarter and 38% in the first half of 2022 driven by continued focus on revenue quality and cost management.

Higher purchased transportation costs, network inefficiencies, and higher wage rates as a result of constrained labor market conditions negatively affected results in the second quarter and first half of 2022.

Salaries and employee benefits expense increased 12% in the second quarter and 14% in the first half of 2022 primarily due to higher volumes, network inefficiencies and higher labor costs in the constrained labor market, increased utilization of healthcare benefits, and merit increases.

Purchased transportation expense increased 17% in the second quarter and 27% in the first half of 2022 primarily due to the challenging labor market resulting in increased utilization of third-party service providers, as well as higher fuel surcharges and rates.

Fuel expense increased 63% in the second quarter and 82% in the first half of 2022 primarily due to increased fuel prices. The net impact of fuel had a moderate benefit to operating income in the second quarter and first half of 2022 as higher fuel surcharges outpaced increased fuel prices. See the “Fuel” section of this MD&A for a description and additional discussion of the net impact of fuel on our operating results."

No mention of the BENEFIT of employee retention that these increased (salaries) costs impacted. Also worth noting, As a percentage of revenue, the cost of "salaries and benefits", among other things, went DOWN. Huge revenue gains tend to do that.

it kind of did ...

it kind of did ... it kind of did ...

it kind of did ...

: about ground

: about ground