You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Yellow | In tax terms ( taking a loss )

- Thread starter jacks

- Start date

So, one is to place a value on awarded options that were never exercised and claim a loss? Mine must have been worth MILLIONS!!

The man never said anything about exercising I'm out

The man never said anything about exercising I'm out

My New Year's resolution is going to be to exercise more.

Maybe I will buy YRCF !!!!!!

I heard that Donny Deutsch might be interested in buying YRCW also.

Help me out here:So, one is to place a value on awarded options that were never exercised and claim a loss? Mine must have been worth MILLIONS!!

A stock option is a contract that gives the holder the right to buy or sell a specific quantity of a stock at a particular price on or before a specific date. Options can be sold to another investor, exercised through purchase or sale of the stock or allowed to expire unexercised. Losses on options transactions can be a tax deduction.

The part about it not having to be exercised and allowed to expire

Help me out here:

A stock option is a contract that gives the holder the right to buy or sell a specific quantity of a stock at a particular price on or before a specific date. Options can be sold to another investor, exercised through purchase or sale of the stock or allowed to expire unexercised. Losses on options transactions can be a tax deduction.

The part about it not having to be exercised and allowed to expire

If you purchase options and don't exercise them (let them expire) then they are assumed to have been sold for $0.00 for tax purposes. Let's say you purchase $1000 worth of options and they expire you'll then have a $1000 loss (long or short term depending on how long you held them) to declare on your tax return.

Look at it this way, say you bought a ticket (option) for the Super Bowl. The ticket has value BEFORE the event, but if you don't go to the game (you don't exercise the option), the ticket is worthless after the game is played (the option expires). Of course you can't deduct the cost of the ticket like you can an option. :)

Last edited:

Help me out here:

A stock option is a contract that gives the holder the right to buy or sell a specific quantity of a stock at a particular price on or before a specific date. Options can be sold to another investor, exercised through purchase or sale of the stock or allowed to expire unexercised. Losses on options transactions can be a tax deduction.

The part about it not having to be exercised and allowed to expire

There needs to be a 'basis,' a point from which value is derived.

There is no basis in the YRCW options/warrants.

There was never any statement by corporate that our sacrifice would be compensated at any specific rate.

Sacrifice? Like on altars? Lambs or virgins? And here I thought you worked hourly, for wages.....There was never any statement by corporate that our sacrifice would be compensated at any specific rate.

metalmikex

TB Regular

- Credits

- 0

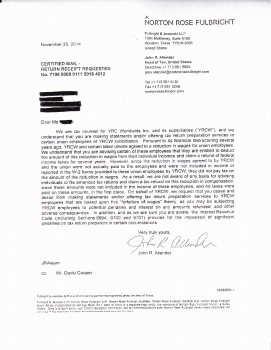

Now, once and for all, can we finally put this issue to bed and end the fairy tale?

Now, this issue has been put to rest. No more banter about whether it can be done.

If one chooses to follow through, one is taking their own risk.

Any that attempt to resurrect this urban legend should be stifled.

This thread should be closed with a big ole'

!

Once upon a time......................Now, once and for all, can we finally put this issue to bed and end the fairy tale?

You're sooooo logical! ;-)If you purchase options and don't exercise them (let them expire) then they are assumed to have been sold for $0.00 for tax purposes. Let's say you purchase $1000 worth of options and they expire you'll then have a $1000 loss (long or short term depending on how long you held them) to declare on your tax return.

Look at it this way, say you bought a ticket (option) for the Super Bowl. The ticket has value BEFORE the event, but if you don't go to the game (you don't exercise the option), the ticket is worthless after the game is played (the option expires). Of course you can't deduct the cost of the ticket like you can an option. :)

You're sooooo logical! ;-)

Thank you, although I'm aware that many might prefer to use the word "anal" instead. :D

that should end the 'our money' scenario too. But it won't...

Could we please just have the guy in Tennessee look at this letter???? I want to make sure if I should cash my check I don't have the IRS trying to seize my Cayman account !!!!Now, this issue has been put to rest. No more banter about whether it can be done.

If one chooses to follow through, one is taking their own risk.

Any that attempt to resurrect this urban legend should be stifled.

This thread should be closed with a big ole'

!

Under the new system, I can only sent a like. I liked the old way- I'd sent reputation greenies. At the very least you deserve a big Thank You! Go get your wife to hug you...

Hey Kook. Is that rifle made of tin foil ?????Under the new system, I can only sent a like. I liked the old way- I'd sent reputation greenies. At the very least you deserve a big Thank You! Go get your wife to hug you...