D

Docker

Guest

Damm Docker that would make for a Happy New Year. Look how excited they are to win a date with Joe. Now that is funny.

I'll get back to you after New Years...don't have much time right now...lol

Damm Docker that would make for a Happy New Year. Look how excited they are to win a date with Joe. Now that is funny.

chumley, ABF isn't the only company that will be making major concessions. I believe they all will. Of course there are some that hope they will be the only company that won't. But its coming to all...

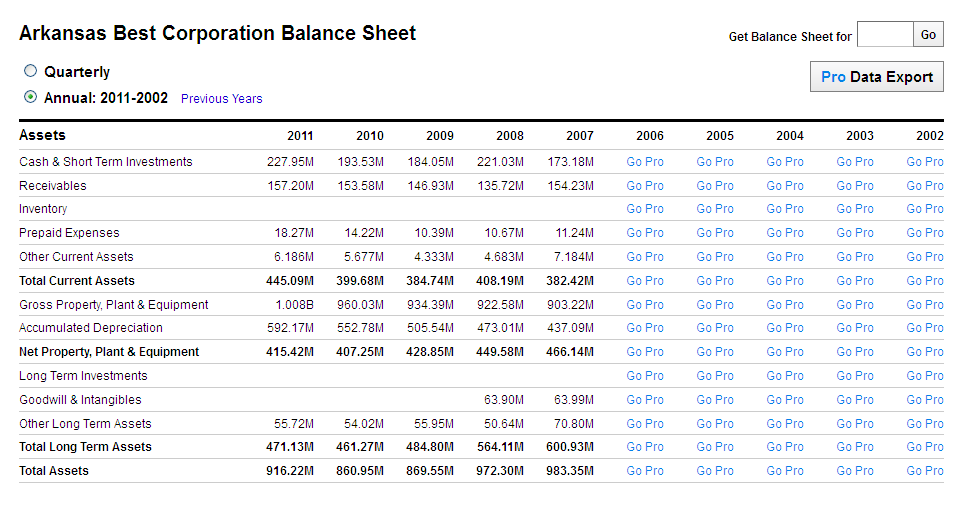

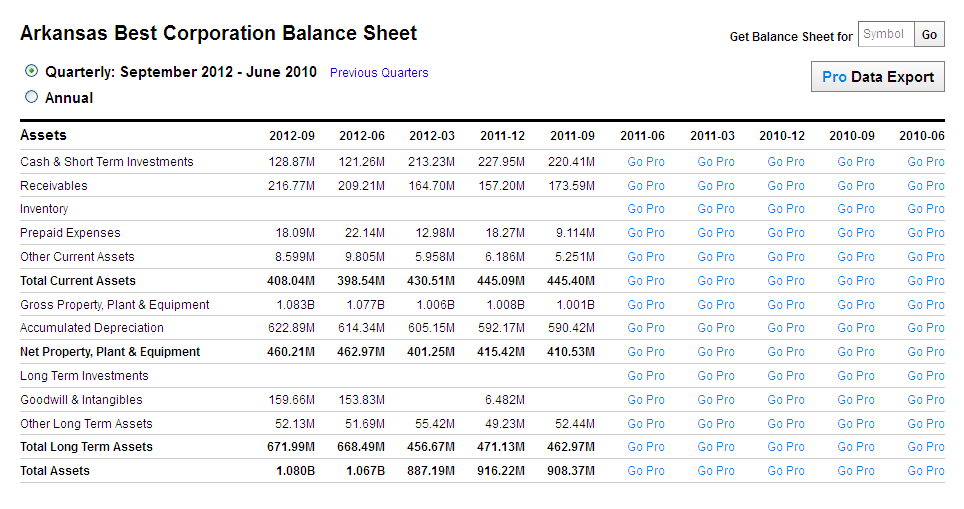

The highest teamster employment that I ever remember seeing at ABF was 11,000. When the vote is against what the company wants, (and I see no other outcome), they could take the employment level down to 5,500 to 5,400. That would be half of their highest level or slightly less. The company needs to shrink to a level that will allow them to survive the next recession. The rate of growth from the 2008-2009 recession was pathetic and now the rate of growth is declining. It would not surprise me if the company gave up on servicing 50 states and became a multi regional LTL freight company.

If ABF does not get the concessions that they want, (and they won’t), they will cut the amount of discount given to customers and increase their margins on each shipment. ABF is in the LTL business to move freight profitably and if they cannot obtain a sufficient margin at the current freight levels they will cut the amount of freight that they haul by doing it at a higher price net of discounts given. ABF is not in the business of providing jobs to truck drivers.

The best case scenario that they could get from the road drivers is a pay freeze for three years and a change to the work rules that would be beneficial to them. They cannot touch benefits or get a pay decrease from the road drivers.

Do you really think ABF is not making money right now? They are, .....

Arkansas Best Corp Three months ended September 30

____________________2012……….…2011

Operating revenue… 577,546 _____ 510,887

Operating expenses...565,313 _____ 489,769

Operating Income…..012,233_____ 021,118

Earnings per share_____.0.24_________0.46

http://www.arkbest.com/news/pr/PDF/2012/3Q_12_Earnings_Release.pdf

Let me guess, no one sees a problem here do they.

Arkansas Best Corp Three months ended September 30

____________________2012……….…2011

Operating revenue… 577,546 _____ 510,887

Operating expenses...565,313 _____ 489,769

Operating Income…..012,233_____ 021,118

Earnings per share_____.0.24_________0.46

http://www.arkbest.com/news/pr/PDF/2012/3Q_12_Earnings_Release.pdf

Let me guess, no one sees a problem here do they.

Arkansas Best Corp Three months ended September 30

____________________2012……….…2011

Operating revenue… 577,546 _____ 510,887

Operating expenses...565,313 _____ 489,769

Operating Income…..012,233_____ 021,118

Earnings per share_____.0.24_________0.46

http://www.arkbest.com/news/pr/PDF/2012/3Q_12_Earnings_Release.pdf

Let me guess, no one sees a problem here do they.

[/url]

Let me guess, no one sees a problem here do they.

My biggest issue with the job is listening to all of the worthless complaints by senior bid drivers about the job. The complaints are bizarre, petty, and just unbelievable.

FORT SMITH, Ark., Oct. 26 /PRNewswire-FirstCall/ -- Arkansas Best Corporation (Nasdaq: ABFS - News) today announced third quarter 2007 net income of $18.9 million, or $0.75 per diluted common share, compared to third quarter 2006 net income of $31.5 million, or $1.24 per diluted common share. Arkansas Best's third quarter 2007 revenue was $479.8 million compared to third quarter 2006 revenue of $507.3 million.

Arkansas Best Corporation - Press Release

You have a company that used to earn $1.24 per share now earning $0.24 per share. That is not a problem for you is it.

http://www.arkbest.com/news/pr/PDF/2012/3Q_12_Earnings_Release.pdf

The cost of a new truck is up $20,000 just in air pollution control alone over the cost of a 2006 truck. Everything else on that truck has also increased. If you read Transport Topics you will find articles that reveal that there are some small carriers trading in two trucks to buy one truck. This is due to increased down payment requirements by the lending companies and the cost of trucks going up.

The cost of a new truck is up $20,000

July 18, 2002 there was a Liberal Republican in the White house. He increased the debt of the country 4 trillion dollars in 8 years. Owe-bama has increased the debt 6 trillion dollars in 4 years and said “THIS IS BUSHES FAULT”.

Why would anyone have any confidence in their earnings per share going up besides the Oil companies.

A vote to decrease wages will never pass, just like in May 2010. The company will decrease the discounts they give to customers a little and ABF will lose a few shipments here and there from the companies that keep shipping with ABF. There will be a few drivers laid off which is nothing new to Union LTL companies. Nothing for a senior driver in the top 25% of the seniority list to worry about. The rest may not get the bid that they wanted and the bottom bid drivers may be kicked back to the extra board but no big deal otherwise.